As the usual April 15 tax filing deadline approaches, the IRS has announced an extension for taxpayers in certain states affected by Hurricane Helene. If you reside in one of the seven designated states, you now have until May 1, 2025, to file your federal tax return.

🙋🏽♀️Who Qualifies for the Extension?

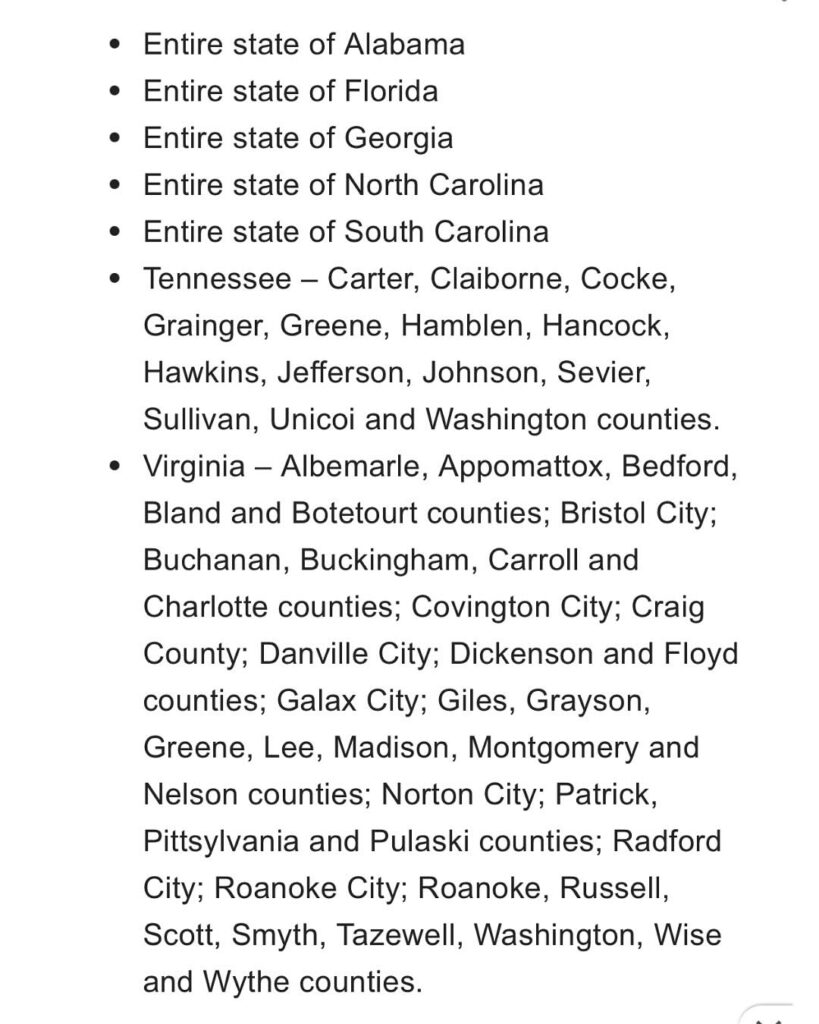

Taxpayers living in federally declared disaster areas impacted by Hurricane Helene are eligible for this automatic extension. The IRS has extended the deadline to May 1 for affected individuals and businesses in parts of the following states:

1. Florida

2. Georgia

3. North Carolina

4. South Carolina

5. Alabama

6. Mississippi

7. Louisiana

🤷🏽♀️ What If You’re Not in an Affected State?

If you don’t live in one of the seven listed states and are not located in a qualifying disaster area, April 15 remains your federal tax deadline. However, if you’re not ready to file your return by then, you can request a tax filing extension.

Filing an extension gives you until October 15, 2025, to submit your tax return, but it does not extend the deadline to pay any taxes owed. To avoid penalties and interest, you should estimate and pay any taxes due by April 15.

🗓️ How to File for an Extension

Contact @dr.rosiethomas, an industry leader with over 20 years experience in the tax and accounting industry. Helping entrepreneurs structure their business and save on taxes so they can focus on growing their business. Call (214) 717-6200 to connect with Dr. Rosie today!